Many people are asking where the stock market stands today navigating a complex landscape of economic factors and investor sentiment. This comprehensive article delves into the current state of the stock market dissecting key drivers like inflation interest rates corporate earnings and technological advancements. We explore how these forces are shaping market performance impacting various sectors and influencing investor decisions. Discover actionable insights and a clear understanding of the present market environment to empower your financial journey. Understanding where the stock market is right now is crucial for informed investing. This piece offers a readable and engaging perspective ensuring you grasp the nuances of market trends and outlook. It is designed to be a trending resource providing valuable information for both seasoned investors and those new to the financial markets. We aim to equip you with the knowledge to navigate todays dynamic financial world with confidence and clarity. Dive into a detailed analysis that answers your burning questions about the current market climate.

Many of us are asking, Where is the stock market at right now? It is a crucial question for anyone managing their finances, whether you are a seasoned investor or just starting out. Currently, the stock market is navigating a complex landscape, heavily influenced by fluctuating inflation, central bank interest rate policies, ongoing geopolitical shifts, and the resilient, yet often surprising, performance of corporate America. When we look at the what of the market, we see sectors responding differently to these pressures, with technology often leading the charge while others experience more subdued growth. The when refers to this present moment, a period marked by both uncertainty and opportunity, making it vital to understand the underlying currents shaping asset values. Why does this matter? Because your financial well-being, from retirement savings to investment goals, is directly tied to these movements. This article aims to help you comprehend how these factors converge, offering a clear, plain-English perspective on the markets current position and what it might mean for your investment journey today. It is about empowering you with knowledge, ensuring you feel confident in your financial decisions, and providing a comprehensive overview of where is the stock market at right now.

Overall Market Performance: Where Is the Stock Market Right Now?

When we examine the overall market performance, a picture of resilience mixed with cautious optimism emerges. What does this truly mean for investors? The major indices, such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, have shown a remarkable ability to rebound from previous dips, often driven by strong corporate earnings reports and a sustained interest in growth sectors. This rebound, happening when specific economic data points provide relief or clarity, suggests that despite underlying anxieties, the market continues to find reasons to push forward. How is this resilience sustained? A significant factor is the continued consumer spending in certain areas and the innovative strides in technology, which consistently capture investor imagination and capital. Where exactly does this place us? We are in a phase where market participants are constantly re-evaluating their positions, balancing the potential for further upside against lingering economic headwinds. It is a dynamic period where every piece of news, from inflation figures to employment reports, can shift sentiment, reminding us why staying informed is not just helpful, but absolutely essential for navigating where is the stock market at right now. Understanding these broad movements provides a foundational view before diving into specific drivers and sectors.

Key Economic Drivers: Where Is the Stock Market Right Now?

Understanding the key economic drivers is paramount to grasping where is the stock market at right now. What exactly are these drivers, and how do they influence asset prices? The primary forces at play include inflation rates, central bank monetary policy (especially interest rates), employment data, and global economic growth figures. When inflation rises, it erodes purchasing power and can prompt central banks, like the U.S. Federal Reserve, to increase interest rates to cool the economy. This, in turn, can make borrowing more expensive for businesses and consumers, potentially slowing economic activity and impacting corporate profits. Why does this matter so much? Because these actions directly affect company valuations and investor confidence. Strong employment numbers, on the other hand, often signal a healthy economy with robust consumer spending, which typically bodes well for corporate revenues. Where do these indicators point us today? They suggest a tug-of-war between inflationary pressures and the efforts to stabilize prices, with the market reacting sensitively to each new data release. Investors are constantly weighing these factors, attempting to predict their trajectory and how they might shape the markets immediate future, making a clear comprehension of where is the stock market at right now hinge on these fundamental economic forces.

Inflation and Interest Rates: Where Is the Stock Market Right Now?

The intertwining forces of inflation and interest rates are undoubtedly among the most talked-about topics when discussing where is the stock market at right now. What is the current situation with these vital economic components? We have witnessed a period of elevated inflation, which has prompted central banks globally, including the Federal Reserve, to implement a series of interest rate hikes. When these rates go up, the cost of borrowing increases across the board, impacting everything from mortgages to corporate loans. How does this directly affect the stock market? Higher interest rates can reduce the present value of future earnings for companies, making growth stocks, which are valued on their long-term potential, particularly susceptible. Furthermore, a higher risk-free rate, such as that offered by government bonds, makes these safer assets more attractive, potentially drawing capital away from riskier investments like stocks. Why is the market so sensitive to every pronouncement from the Fed? Because their decisions directly dictate the cost of capital and the overall liquidity in the financial system. Where do we stand now? The market is actively trying to gauge when the Fed might pause or even begin to cut rates, a move that could provide significant tailwinds for equity valuations. Understanding this delicate balance is key to comprehending the current market climate and effectively answering where is the stock market at right now.

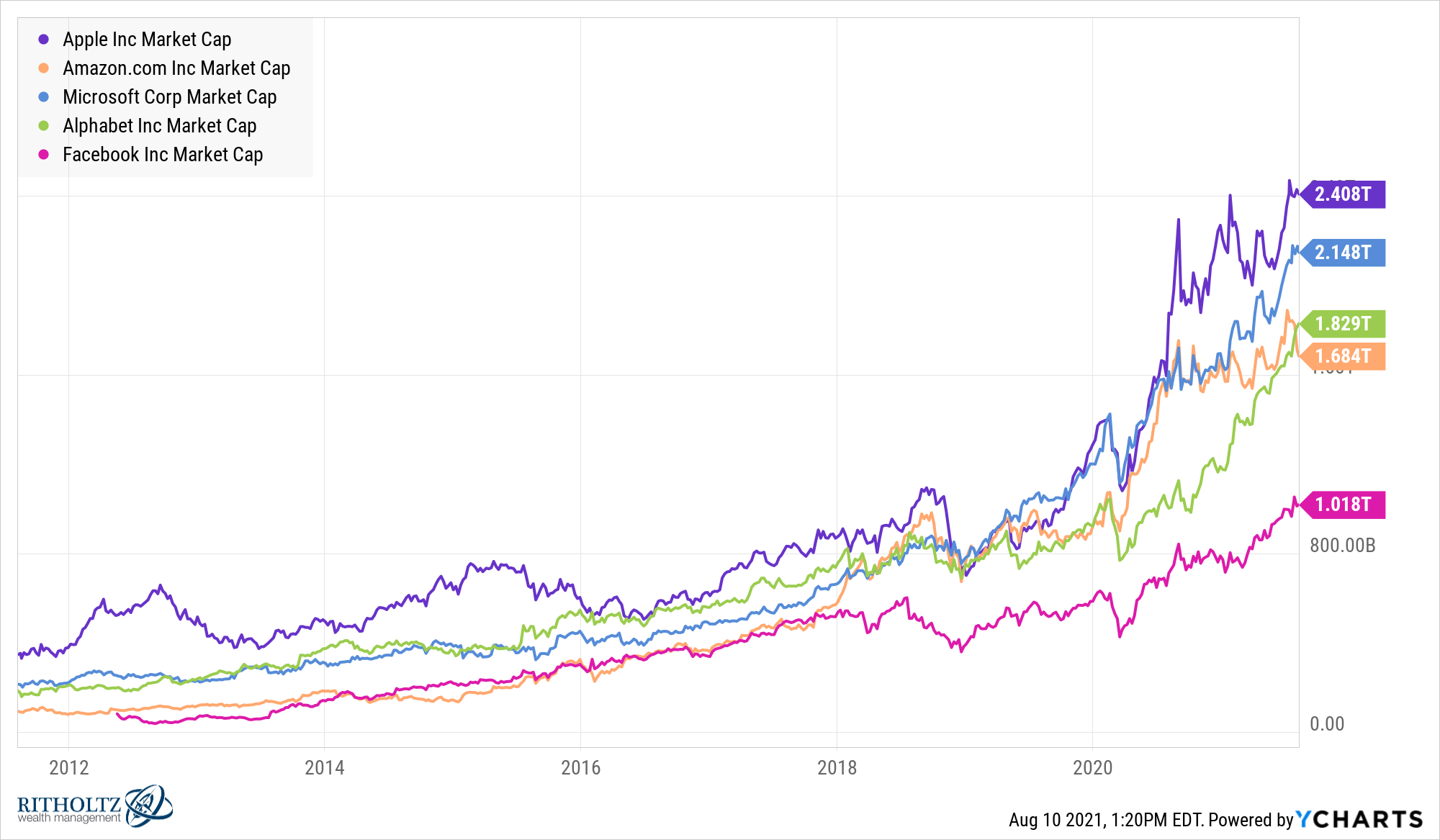

Corporate Earnings and Techs Role: Where Is the Stock Market Right Now?

When we peer into the health of individual companies, corporate earnings become a critical barometer for where is the stock market at right now. What do recent earnings reports tell us? Despite broader economic uncertainties, many companies have continued to report surprisingly strong earnings, or at least have managed to exceed analyst expectations. This resilience in corporate performance provides a foundational support for equity valuations, demonstrating that businesses can adapt and find avenues for profitability even in challenging environments. How does this play out across the market? Strong earnings from major corporations, particularly within the technology sector, often act as significant drivers for overall market gains. Tech companies, for example, frequently benefit from innovation cycles, digital transformation trends, and increasing automation, allowing them to capture substantial market share and generate impressive revenue growth. Why is technology’s role so pronounced? Because these firms are at the forefront of driving efficiency, developing new products, and often possess scalable business models that can thrive irrespective of minor economic fluctuations. Where does this leave us? We are in a period where the market heavily rewards companies that can demonstrate consistent growth and strong margins, especially those leveraging advancements like artificial intelligence. This makes understanding the earnings landscape, and how tech continues to shape it, absolutely essential for anyone asking where is the stock market at right now.

Sectoral Insights: Where Is the Stock Market Right Now?

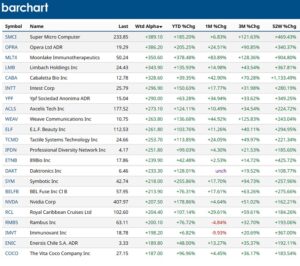

Diving deeper, examining specific sectors provides a more nuanced understanding of where is the stock market at right now. What sectors are currently thriving, and which are facing headwinds? Technology, as often highlighted, continues its robust performance, driven by advancements in AI, cloud computing, and software solutions, capturing significant investor interest. Communication services and consumer discretionary sectors, particularly those with strong digital footprints, also show resilience as consumer habits shift. How do other sectors fare? Energy, for example, remains sensitive to global oil prices and geopolitical events, experiencing volatility but also periods of strong returns. Financials navigate the changing interest rate landscape, with higher rates potentially boosting net interest margins but also raising concerns about loan demand and credit quality. Healthcare, often seen as a defensive sector, maintains stability due to consistent demand for services and innovation in biotechnology and pharmaceuticals. Why do these differences matter? Because understanding these sectoral variations helps investors diversify their portfolios and capitalize on specific trends. Where should one look for opportunity? It is about identifying industries with strong fundamentals, clear growth catalysts, and resilient business models that can weather various economic conditions. A clear picture of where is the stock market at right now demands a look beyond the averages, into the specific industries shaping our economic future.

| Key Market Indicator | Current Status (Approximate/Trend) | Impact on where is the stock market at right now |

|---|---|---|

| Inflation Rate (CPI) | Elevated but moderating | Influences interest rate policy and consumer purchasing power. |

| Federal Funds Rate | Higher than recent historical averages | Affects borrowing costs for businesses and attractiveness of bonds. |

| Unemployment Rate | Historically low | Supports consumer spending and corporate revenues. |

| S&P 500 Performance | Resilient, showing upward trend | Reflects broad market health and investor confidence. |

| Corporate Earnings Growth | Mixed but often exceeding expectations | Drives stock valuations and sector-specific performance. |

| Consumer Confidence | Fluctuating but showing signs of improvement | Key for future economic growth and discretionary spending. |

| Geopolitical Events | Ongoing uncertainty (e.g., conflicts, trade) | Introduces volatility and affects specific sectors (e.g., energy, defense). |

Investor Sentiment and Future Outlook: Where Is the Stock Market Right Now?

Investor sentiment offers a fascinating lens through which to view where is the stock market at right now, reflecting the collective mood and expectations of market participants. What characterizes current sentiment? It is a blend of cautious optimism and underlying apprehension. On one hand, the markets ability to absorb economic shocks and continue its upward trajectory fosters a sense of resilience. On the other hand, persistent concerns about inflations stickiness, the future path of interest rates, and unexpected geopolitical developments keep a lid on excessive euphoria. How do investors process these mixed signals? They are constantly weighing the likelihood of a soft landing for the economy versus the potential for a more significant slowdown. When new economic data is released, sentiment can swing rapidly, emphasizing the markets immediate reactions to information. Why does sentiment matter so much? Because collective beliefs and emotions can create self-fulfilling prophecies, driving both rallies and corrections. Where do experts see us heading? While predicting the future is impossible, many analysts suggest a period of continued volatility but also selective opportunities, emphasizing a focus on quality companies with strong balance sheets. Staying level-headed and informed is crucial for navigating where is the stock market at right now without succumbing to emotional trading decisions.

What Should Investors Do Now? Where Is the Stock Market Right Now?

Given the current market dynamics and a clear understanding of where is the stock market at right now, what actionable steps can investors take? The most empowering approach involves a disciplined strategy rather than reactive decisions. Firstly, how important is diversification? Extremely. Spreading your investments across different asset classes, sectors, and geographies helps mitigate risk, ensuring that no single downturn significantly impacts your entire portfolio. Secondly, why is a long-term perspective so crucial? Because short-term market fluctuations, while attention-grabbing, often smooth out over longer periods, allowing the power of compounding to work its magic. Resist the urge to panic sell during dips or chase every hot trend. Thirdly, when should you rebalance your portfolio? Regularly reviewing your asset allocation to ensure it aligns with your risk tolerance and financial goals is vital, perhaps annually or semi-annually. This means selling assets that have performed exceptionally well to buy those that may be undervalued, maintaining your target percentages. Finally, who should you consult? If you feel overwhelmed, speaking with a qualified financial advisor can provide personalized guidance tailored to your unique situation. Empower yourself with knowledge, act with purpose, and remember that consistent, informed action is far more valuable than trying to perfectly time the market, especially when you are trying to understand where is the stock market at right now for your own financial journey. What is the current state of the stock market right now? The stock market is navigating a complex period of resilience and volatility, driven by economic data, corporate performance, and evolving investor sentiment. Keywords: current stock market, stock market outlook, investing trends, economic indicators today, market analysis, inflation impact on stocks, interest rates and market, portfolio management strategies, where is the stock market at right now, market updates, investment guidance, financial health

The stock market is currently navigating a dynamic period influenced by elevated but moderating inflation, central bank interest rate policies, strong corporate earnings (especially in tech), and geopolitical uncertainties. Resilience is a key theme, with major indices showing upward trends despite volatility. Investor sentiment remains a blend of cautious optimism. Diversification and a long-term perspective are crucial for investors.

Stock Market Today Forecast For Next 3 Month 6 Month 5 Years 2024 Highest Performing Stocks Right Now 300x266 Top 5 Growth Stocks To Watch Before 2026 WhatsApp Image 2025 06 04 At 10.45.08 AM.webpThe Ultimate Growth Stock To Buy With 1 000 Right Now

5 Canadian Growth Stocks To Buy And Hold For The Next 15 Years The Stocks Climbing Green Bull Market 1200x686 Top 10 Stocks To Buy Right Now For Long Term Growth In 2025 Stocks To Buy Right Now .webpLive Nasdaq Composite TSLA NVDA And PLTR Rise 24 7 Wall St Stock Market Today How Major US Stock Indexes Fared Thursday 11 20 2025 Small 10 Best Stocks 2026

Top 5 US Lithium Stocks Updated January 2026 The Great Assets Glowing Blue Neon Batteries With Lightning Symbols On A Dark Gradient Background BEJ2pE 800x533 1 Sensex Could Hit 107 000 By 2026 End Says Morgan Stanley Predicts Why Stock Market Is Rising Today Sensex Jumps Over 900 Pts Nifty Above 23150 4 Factors Behind Todays Surge 2025 03 16x9 China Stock Market Today Live Chart Stocks Crash At 10 Open 99Bitcoins Screenshot 13 1024x637 COST Stock Rises As E Commerce Growth Offset Tariff Pressures Small Videolive3

How Overvalued Is The Stock Market Right Now A Wealth Of Common Sense AAPL AMZN MSFT GOOGL FB Chart Is The Stock Market Going To Crash In 2026 Here Is What History SuggestsIf A Stock Market Crash Is Coming In 2026 There S 1 Smart Move ForShould You Really Be Investing In The Stock Market Right Now History Image

Here Are The Stock Market Charts To Watch Right Now SP500 Stock Market Today Live Updates 107224262 Aa7 Img 100 99 112 1917665 1000 Stock Market Predictions 2026 Trader Outlook Stock Market Predictions 2026 Header.webpWill Real Estate Crash Or Rebound In 2026 Will The Real Estate Market Boom Or Crash In 2026 Expert Predictions 1024x585

2 Top Small Cap Stocks To Buy Right Now For 2026Walmart Stock Price Prediction 2025 2030 2040 2050 Microsoft Stock PriceShare Market Open LIVE Top Stocks To Watch Out For In Trade Stock Top Stocks To Double Up On Right Now

Stock Market Forecast For Next 3 Months 6 Months 5 Years 2024 2025 2026 Google Finance Market Trending Upward Why The Stock Market Is Down Lately Explained Vox 1074333778 .0 Stock Market For Beginners 2025 2026 BEST STOCKS FOR BEGINNERS TO BUY 7 Powerful Market Trends Shaping 2026 Trading Emerging Markets And Crypto Trends 2026.webp

5 Predictions For The Stock Market In 2026 And Which Stocks WillStock Market Today Live Updates Planet Updates Hub 107217336 Aaa7 Img 100 99 112 1957665 1000 Should You Really Invest In The Stock Market Right Now Here S Warren ImageJust How Safe Is The Stock Market Right Now History Has Good News For Image

Outlook For Canadian Natural Resources Stock In 20262026 Financial Forecast Stock Market Projections Investment Financial Forecast Stock Market Projections Investment Strategies Charts Data Future Trends Economic Outlook Analysis 365101799 Just How Safe Is The Stock Market Right Now History Has Good News For Image

/cdn.vox-cdn.com/uploads/chorus_image/image/62702203/1074333778.jpg.0.jpg)