Navigating the world of insurance can feel overwhelming, but finding the best insurance is crucial for safeguarding your future and financial well-being. This guide cuts through the complexity, offering clear, actionable insights into selecting policies that genuinely meet your needs in 2026. We explore various types of coverage, from health and life to auto and home, helping you understand their importance and how they function. Discover essential tips for comparing quotes, evaluating providers, and customizing plans to ensure comprehensive protection. This informational resource empowers you to make confident decisions, ensuring you secure the optimal best insurance tailored for your life's unique journey. Learn what to prioritize, how to spot value, and ultimately, gain peace of mind through informed choices. Protect yourself and your loved ones with the best insurance available today.

H1 Finding the Best Insurance for Your Life's Journey Finding the best insurance involves understanding who needs protection, what types of coverage exist, when to secure policies, where to find reliable providers, why it is crucial for financial stability, and how to effectively compare options. It is about securing peace of mind against life's uncertainties, whether for your health, home, vehicle, or future. This comprehensive guide helps you navigate the complexities of securing truly best insurance tailored to your unique circumstances and evolving needs in 2026. We empower you to make informed decisions for ultimate protection. H2 Understanding What Best Insurance Truly Means Best insurance is not a one-size-fits-all product; it is a personalized solution that aligns with your individual risks, assets, and future aspirations. It means having the right coverage amounts, manageable deductibles, and reliable support when you need it most. Truly excellent insurance offers comprehensive protection without unnecessary expenses. It ensures your financial safety net is robust, responding effectively to unforeseen events like accidents, illness, or property damage. Selecting the best insurance requires careful consideration of your current life stage and potential future needs. A young professional might prioritize health and auto coverage, while a growing family focuses on life and home insurance. Regularly assessing these needs helps ensure your policies remain relevant and effective. You want coverage that evolves with you, providing continuous peace of mind through every phase of life with the best insurance. H2 Key Considerations When Choosing Your Best Insurance Policy When evaluating insurance policies, consider several critical factors to ensure you select the best insurance for your situation. Financial strength ratings of an insurer indicate their ability to pay claims reliably. Customer service reviews offer insight into how well a company supports its policyholders, especially during stressful claims processes. These aspects are vital for a positive and secure insurance experience. Policy terms and conditions are also paramount; understanding what is covered, what is excluded, and your responsibilities as a policyholder prevents future surprises. Comparing quotes from multiple providers helps you find competitive rates without compromising on essential coverage. Remember, the cheapest policy is not always the best insurance if it leaves significant gaps in your protection. H2 Top Questions About Best Insurance What Others Are Asking H3 What is the best type of insurance to get for me The best type of insurance for you depends entirely on your personal circumstances, including your age, health, assets, dependents, and lifestyle. Common essential types often include health, auto, and life insurance. A thorough needs assessment helps pinpoint the most critical coverages you should prioritize to protect your financial stability. H3 What are the top 5 best insurance companies Identifying the top 5 best insurance companies involves evaluating factors like customer satisfaction, financial stability, claims processing efficiency, and coverage options. Major players often cited for strong performance across various insurance types include State Farm, Geico, Progressive, Allstate, and Liberty Mutual. However, the best choice for you may depend on your specific needs and location. H3 How do I choose the right insurance policy for my needs To choose the right insurance policy, begin by assessing your risks and assets, determining what you need to protect. Research different types of coverage and compare quotes from several providers, paying close attention to policy details, deductibles, and customer reviews. Consult with an independent agent for personalized advice. H3 Is it better to have one insurance company or multiple for best insurance Consolidating policies with one insurer can often lead to multi-policy discounts, simplifying management and potentially lowering overall premiums. However, shopping around with multiple companies might reveal better rates or more specialized coverage for certain needs. Weigh the convenience of bundling against potential savings or unique offerings from different providers to find the best insurance strategy. H3 What is the most important insurance to have for financial security While individual needs vary, health insurance is often considered the most important due to high medical costs. Life insurance is crucial if you have dependents, and auto insurance is generally legally required and protects against significant financial loss. Homeowners or renters insurance also provides vital asset protection. H3 How often should I review my insurance needs for optimal coverage You should review your insurance needs at least once a year, or whenever significant life events occur, such as marriage, birth of a child, purchasing a home or car, or changing jobs. These events can drastically alter your risk profile and coverage requirements, making regular reviews essential for maintaining the best insurance protection. H3 Can I get insurance without a job finding the best insurance Yes, you can often get insurance without a job, though specific types might be more challenging. Health insurance can be obtained through the marketplace or COBRA. Auto insurance is typically available to anyone with a valid license, and life insurance generally requires a financial need, which can still exist without employment. Explore options carefully for the best insurance solutions. Best Insurance Options at a Glance Coverage Type Primary Purpose Key Considerations Health Insurance Medical expenses Network, deductibles, co-pays Life Insurance Financial support for dependents Term vs. whole, coverage amount Auto Insurance Vehicle damage, liability Collision, comprehensive, liability limits Homeowners Insurance Property damage, liability Dwelling, personal property, liability Renters Insurance Personal property, liability Coverage for belongings, liability Umbrella Insurance Extra liability protection High net worth, additional coverage H2 What Others Are Asking Your Best Insurance FAQ H3 What specifically is best insurance Best insurance refers to a policy or combination of policies that optimally cover your specific risks and provide financial security at a reasonable cost. It means comprehensive protection that fits your budget and lifestyle, offering peace of mind. It is about value, reliability, and appropriate coverage tailored to you. H3 How do I compare different best insurance policies effectively To compare policies effectively, gather quotes from several insurers for similar coverage levels. Pay close attention to deductibles, coverage limits, exclusions, and additional benefits. Also, research each company's financial strength and customer service ratings. This systematic approach ensures you find the best insurance fit. H3 When is the right time to purchase best insurance The right time to purchase insurance is often as soon as you have assets to protect, dependents to support, or legal obligations to meet. Life events like buying a car or home, getting married, or starting a family are prime opportunities. Proactive planning helps you secure the best insurance rates and coverage. H3 Where can I find reliable best insurance providers You can find reliable insurance providers through online comparison websites, independent insurance agents, or by directly contacting well-established insurance companies. Word-of-mouth recommendations from trusted sources and reviews from reputable financial publications are also valuable resources for finding the best insurance. H3 Why is understanding my best insurance policy details so important Understanding your policy details is crucial because it clarifies exactly what is covered, what is excluded, and your responsibilities. This knowledge prevents unexpected denials during a claim and helps you utilize your best insurance effectively. Being informed empowers you to make the most of your protection. H2 FAQ Your Guide to Best Insurance H3 Who needs the best insurance Everyone needs some form of insurance to protect against life's uncertainties. Whether you are an individual, a family, or a business owner, securing the right coverage helps safeguard your financial future and provides essential peace of mind. The best insurance adapts to your specific needs. H3 What does the best insurance cover The best insurance coverage is comprehensive, extending beyond basic protection to include a wider range of scenarios and potential risks. It covers major financial losses due to unforeseen events like accidents, illnesses, property damage, or liability claims. This detailed coverage minimizes your out-of-pocket expenses. H3 Why is having the best insurance important Having the best insurance is vital for financial security, protecting you and your loved ones from catastrophic financial burdens. It provides a safety net during emergencies, allowing you to recover without depleting your savings or incurring massive debt. It is an investment in your stability. H3 How can I find the best insurance deals Finding the best insurance deals involves actively comparing quotes from multiple providers, asking about available discounts, and understanding how bundling policies can save money. Regularly reviewing your coverage needs and adjusting policies as your life changes also ensures you are not overpaying for unnecessary protection. Summary of Key Points for Best Insurance Choosing the best insurance is a crucial decision that impacts your financial stability and peace of mind. It requires understanding your personal needs, comparing various policy options, and selecting a reliable provider with excellent customer service. Regular review of your policies ensures they remain relevant. Remember, the best insurance is tailored to you, providing comprehensive protection against life's unexpected challenges. Prioritize value over mere cost, and invest in a secure future.Personalized coverage options for best insurance, Affordable premiums for best insurance plans, Comprehensive protection features for best insurance, Easy comparison tools for best insurance quotes, Reliable claims process for best insurance, Understanding policy specifics for best insurance.

Top Company 2026 Kununu Albrecht Automatik GmbH Kununu 2026 Best Yearly Premium Auto Insurance In 2026 Our Top 10 Picks Best Yearly Premium Auto Insurance 5 1024x576 What S Behind ACA Premium Increases For 2026 Insurance News Whats Behind ACA Premium Increasets For 2026 1150x610

Best Auto Insurance For Seniors In New York Top 10 Companies For 2026 Can You Get Auto Insurance Without A License 1 1 1024x576 CVS Health Leaving ACA Marketplace 2026 What To Do Next Best Maryland Health Insurance Options For 2025 Top 12 Insurance Marketing Agencies In 2026 Insurance Marketing Agencies Scaled What Is Family Floater Health Insurance 2026 Best Super Top Up Health Insurance Plans In 2025

Best Health Insurance Plans 2025 Your Guide To Smart Coverage Best Health Insurance Plans 2025 Your Guide To Smart Coverage 1024x614 9 Big Changes In Health Insurance For 2026 Small Business Health Insurance Everything To Know In 2026 Main Images P 1080 Insurance Trends 2024 Strategic Insights For P C And Life Insurance Web Preview 1200x630 TT24 Insurance Single Premium Life Insurance In 2026 Cost Coverage Quote Com Term Life Insurance 1

Collision Auto Insurance In 2026 What Every Driver Should Know Does My Auto Insurance Cover Rental Cars 1024x576 Motley Fool Money S 2026 Car Insurance Awards The Motley Fool 5ic63G3 Life Insurance Comparison Estimate 2026 Cost Coverage Life InsuranceObamacare 2026 Income Limits Obamacare Income Limits Chart

Loan Insurance Best Health Insurance Plans In India 2026.webpHealth Insurance Premiums To Rise By 15 In 2026 What You Need To Know Marketplace Health Insurance 2026 Compare Plans Open Enrollment 2026 Best Car Insurance Companies January 2026 Insurify Filters Quality(90)

10 Best Car Insurance Providers 2026 Find The Right Policy For You Large C8d43938 7cc5 4d37 A11b Top 15 Best Insurance Companies In The Philippines Best Insurance Companies Philippines 2026 Medicare Premiums Explained Medicare Supplement Chart 2025 2048x2031 Best Health Insurance Options In The U S Updated 2026 Guide Best Health Insurance Options Us 2026

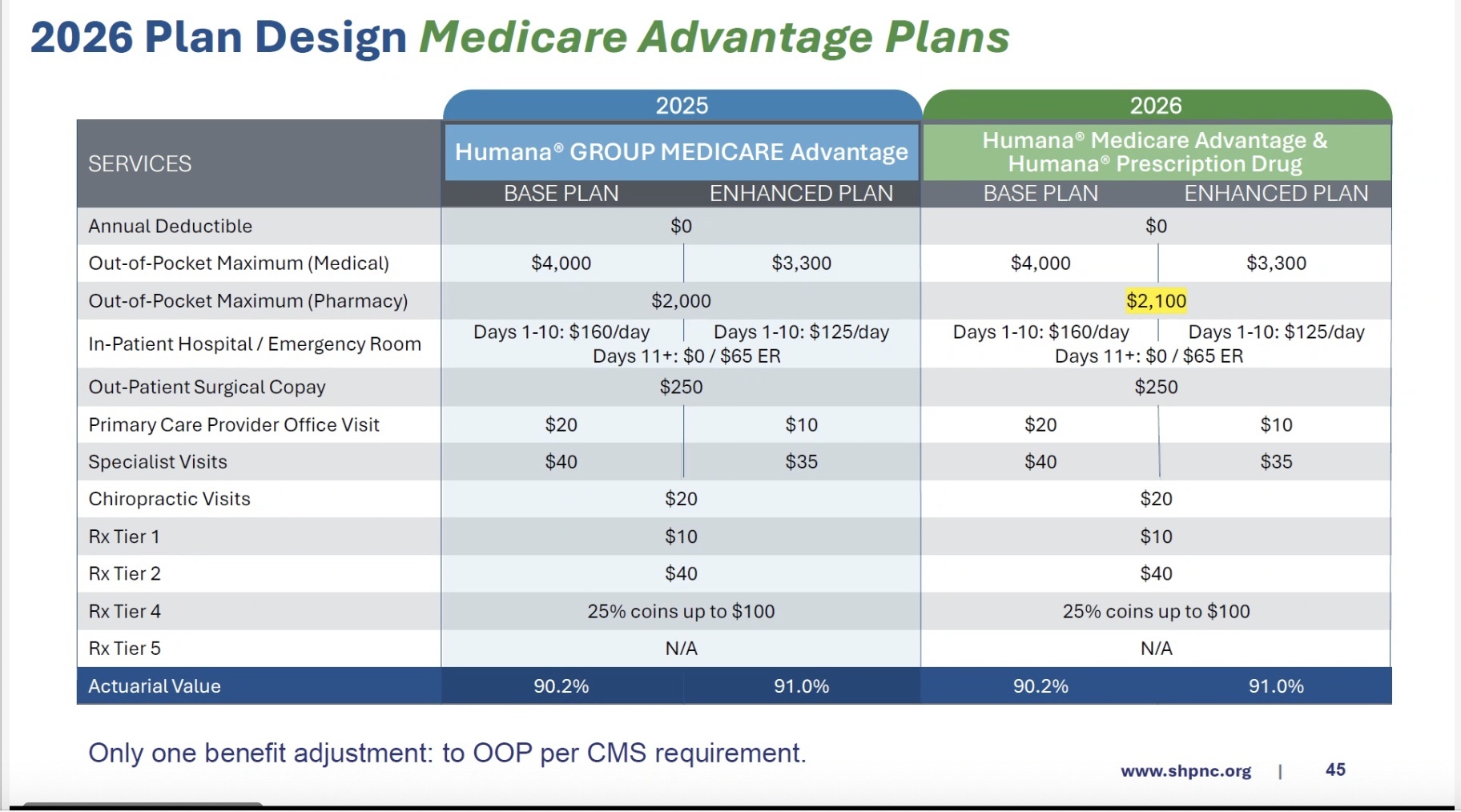

Best Auto Insurance For Seniors In New York Top 10 Companies For 2026 Best Companies For Credit Based Auto Insurance AI 1024x576 2026 Insurance Rate Forecast 7 Trends Every Driver Homeowner 2026 INSURANCE TRENDS State Health Plan Members To See Increased Deductibles And Other 2026 Plan Design Medicare Advantage Plans Best Workplaces In Finance Insurance Application Great Place To Gptw 2026 Australia Best Workplaces In Finance Insurance Colored 1024x1024

10 Best Life Insurance Companies In Canada In 2026 Best Life Insurance Companies In Canada 12026 Medicare Part D Program Compared To 2025 2024 2023 And 2022 1891 Financial Life Ranked Among The 2026 America S Best Insurance Forbes US Insta 1080x1080 Var01 14 Best Insurance Companies To Work For 2024 Awards Best Insurance Company To Work For 1 768x230

Top 10 Health Insurance Plans For Family In India 2026 Health Insurance New Design Main Banner4572 1743761115 Top 10 Insurance Quote Comparison Sites Of 2025 Blog Image 1200628 1 9 Loan Insurance Best Life Insurance Plans In India 2026 Copy.webp

)